Value Line ETFs Service

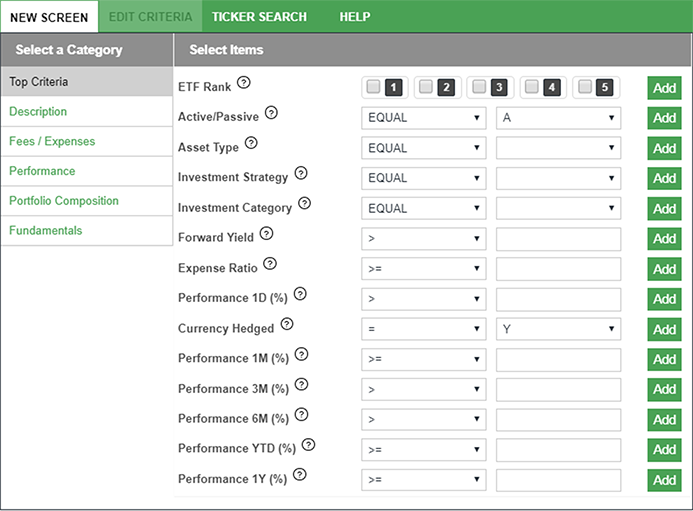

The Value Line ETFs Service is designed to help investors build and manage a diversified portfolio of funds, and the core of the offering is a robust screener that enables users to enter customized and unique search criteria in order to surface only those ETFs that meet the specified conditions. Users have access to approximately 35 fields, including Value Line’s proprietary ETF Rank. The fields are organized via six categories: Top Criteria, Description, Fees/Expenses, Performance, Portfolio Composition, and Fundamentals. Definitions and explanations of each field can be viewed by hovering over the question mark icons. A Help section is also included. There are dozens of fields available for selections. Of particular note is the Value Line ETF Rank. The Value Line Ranking System for ETFs is a unique, proprietary estimate delivered by Value Line. Its goal is to predict an ETF’s future performance relative to all other Value Line ranked ETFs. The quantitative formula behind the ETF Ranks includes several variables, including historical price action, leverage, volatility, and market capitalization. It is available only to subscribers to available the Value Line ETFs Service.

Content Site: www.valueline.com