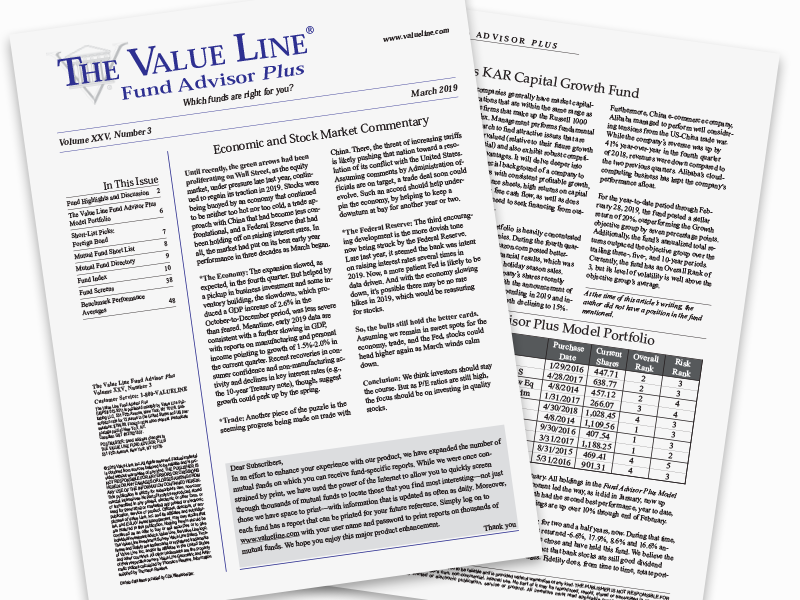

The Value Line® Fund Advisor Plus

The Value Line Fund Advisor Plus gives you access to the entire Value Line database of mutual funds. It covers more than 19,000 mutual funds, grouped into categories and subgroups, defining each fund by investment objective. Our approach measures growth in terms of performance and consistency to ensure investors avoid funds with unsustainably stellar performance. For nearly 25 years, The Value Line Fund Advisor Plus has been guiding mutual fund investors and is committed to providing all the information needed to develop and maintain a well-constructed portion of load, no-load, and low-load mutual funds. A subscription to Fund Advisor Plus includes: • Easy-to-follow analysis of more than 800 load, no-load, and low-load funds • Analyst commentary on markets, the economy, and industry sectors • The Value Line asset-allocation model which uses your personal profile to guide you based on your investment objectives, risk tolerance, and additional criteria Our Ranking System is an objective tool based on algorithms and unbiased investment research. Notably, our no-load funds ranked 1 (Highest) have significantly outperformed those ranked 5 (Lowest). This gives you a clear guide as to which funds aligned with your financial goals. Just as important, The Value Line Mutual Fund Ranking System can help you determine which funds to sell or avoid. As you can see for yourself, the no-load funds ranked 5 (Lowest) on the chart shown above have materially underperformed relative to all other funds. Knowing when to sell may be one of the most difficult aspects of investing but also one of the most important. With our rankings in The Value Line Fund Advisor Plus, you’ll have the information you need to know when to sell, which funds to consider for purchase, and which to avoid. And now the Fund Advisor Plus also includes a new actively managed Model Portfolio that focuses on ETFs across eight major asset classes, including large cap growth, small cap value, foreign stock, and many more.

Issues Per Year: 4